pool ads

pool adsAutodesk, Inc. (NASDAQ:ADSK) Benefitted From Stimulus

When stocks go up as earnings growth declines multiple expansion is usually a simple reason, but unless the company is purposeful in its decision to NOT bring earnings to the bottom line the rationale for multiple expansion diminishes. Arguably multiple expansion without earnings growth is something that happens regularly during environments where excess liquidity exists, and the FOMC stimulus measures are an excellent example of that.

Autodesk, Inc. (NASDAQ:ADSK) has been selected by Stock Traders Daily as the Stock of the Week this week. This article will review the underlying fundamentals of AutoDesk and the basis for its selection within this strategy.

Our fundamental research is based on earnings. Our objective is to identify earnings from operations, so we exclude onetime events from our review. That means special tax considerations are excluded, and other events not pertinent to operations are excluded from our earnings analysis too.

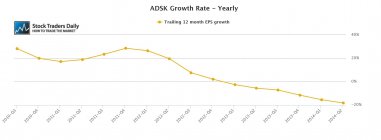

In doing so, we are able to review the underlying growth rate of AutoDesk much more clearly; however, we cannot be nearsighted in our observation either. Every data point is a trailing 12 month review of earnings, so the data we include in our observations also comprises a full year, and that means no seasonal anomalies exist. For AutoDesk, this time, the yearly growth rate is what is most important.

In our yearly growth rate chart for AutoDesk below we can see that the yearly growth rate has been deteriorating and is currently -18%. This is trailing 12 month data, and we're comparing this quarter to the same quarter of last year, the trailing 12 month data from last year, to determine how earnings have changed between now and then. We do this for every quarter and that is how our yearly growth rate chart is devised. It shows us that AutoDesk realized a peak in earnings growth in 2012, and since then the earnings growth has been declining and it is well in negative territory now.

The concern here is absolutely the trajectory of earnings growth, but also very important to this observation is the corresponding PE multiple. At almost the exact same time earnings growth began to deteriorate, the PE multiple for AutoDesk began to increase. That means that the stock increased based on multiple expansion and not on earnings growth.

Market participants can argue the rationale for multiple expansion all they want, but the truth is that when stocks increase based on multiple expansion without corresponding earnings growth it is due at least in large part to an excessive amount of liquidity chasing stocks (Stimulus?). With earnings actually deteriorating, the rational approach is not to buy it, but instead to take money off of the table, but that is not what happened here.

Notwithstanding our longer-term macroeconomic observations, the selection of AutoDesk as the Stock of the Week this week had everything to do with our correlated market observations. Our market observations on Sunday suggested that the markets were beginning to break down, and if they continued to break AutoDesk would likely break with them. The Stock of the Week selection can be long or short, the strategy began in December, 2007, so it has been proven in up and down markets, but by definition, as the title suggests, the trading plan we have outlined for AutoDesk is actionable for this week and this week only.

Stock of the Week (SOW) Strategy:

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :