pool ads

pool adsFundamental and Technical Observations for The Coca-Cola Company (NYSE:KO)

A fundamental and technical evaluation of The Coca-Cola Company (NYSE:KO) is important to determine fair value and the potential for private equity transactions. Initial observations reveal that the current price earnings multiple for Coca-Cola is 21 times trailing numbers, providing a rich valuation given corresponding earnings growth trends.

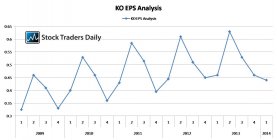

As shown in the chart below, Coca-Cola has been increasing earnings steadily since 2009, but not at a rate that justifies such a high multiple anymore. Earnings have been growing, and that is a good sign, but at current levels the company has two years worth of growth built into it. Normally this would not be a concern, but something very interesting has just happened and will likely continue for at least the next quarter. Specifically, EPS trends are starting to break.

Since 2009 the trend has been a weak fourth quarter followed by a bounce back in the first quarter of the following year. This is the first year that has not happened.

In addition, the forthcoming quarter is not expected to show any growth from the previous year either, so investors could be concerned that Coca-Cola has hit an earnings growth roadblock so to speak.

When this happens, General Investors should be concerned, but institutional investors who are looking to reap the rewards of the cash flow generated from this company may not be as concerned with earnings growth as they are with consistency.

As a result, the notion of a private equity takeover of Coca-Cola is not off of the table even though earnings growth trends are beginning to change.

Of additional and important note, according to our real time trading report for KO the stock is in the process of increasing towards a longer-term level of resistance, it has already tested our longer term support level, and now resistance is within striking distance of the current stock price. Additional upside does look likely, to a moderate extent, but barring any private equity activity our combined analysis will suggest that investors should sell Coca-Cola at resistance when resistance is tested. The stock appears headed that way.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :