pool ads

pool adsHow to Use the Sentiment Table Strategy with QID and QLD

Sentiment Table Strategy

(How to use it)

Trade only when trading is likely to be rewarding; otherwise stay in cash. The Sentiment Table averages 68% of the time in cash and it only trades when trading opportunities look best.

Our Sentiment Table Strategy initiates trading alerts based on signals stemming from our sentiment Table. Our Sentiment Table is an excellent indicator of near term overbought or oversold market conditions, and when those surface the following environment is usually opposite in nature.

Therefore, the opportunities come from identifying these conditions, and then trading in the opposite direction (contrarian). This process has been very efficient, and highly actionable, but there are caveats.

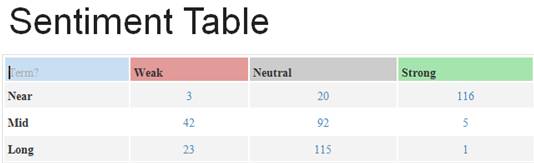

First, here is an example of the Sentiment Table:

The Rules:

- Watch for 100 or more in Near Term Weak

- Watch for 100 or more in Near Term Strong

- If 100 or more in NT-Strong, buy QID

- If 100 or more in NT-Weak, buy QLD

- Max hold time = 2 weeks (sell @ 2 weeks)

- If oversold turns to overbought, take profits

- If overbought turns to oversold, take profits

- Sell Alerts May be made subjectively

- Subjective Alerts are based on technicals

Email Alerts:

You can either monitor the Sentiment Table and follow the rules independently, or use the support of our email alerts as confirmation.

- Email alerts are sent for every trade

- Entry Alerts Always happen when markets are closed

- Closing Alerts May happen During Market Hours.

- Set your phone to monitor for our emails.

- Make sure we are on your safe senders list.

Caveats:

Good opportunities for trading occur when markets are more volatile, not when they are tame, and the Sentiment Table Strategy limits alerts to times when trading is most likely to be rewarding, so that means when markets are more volatile. Therefore, The Sentiment Table only trades when markets are more volatile, but there's more to consider.

In addition, it trades ETFs that are also more volatile. It only trades QID and QLD, which are 2x ETFs for the NASDAQ 100 (NDX), and they are twice as volatile as the market itself. As a result, not only does the Sentiment Table only initiate trades when conditions are more volatile, but it also trades instruments that are more volatile, which makes it very volatile when it is engaged in a position.

However, the long periods of time in cash largely offset that, because there is no volatility or market risk when we hold cash, so although the volatility levels increase when we are in a position, that is offset by cash, and on an annualized basis volatility levels are tamed.

Support and Resistance Plot Chart for

Fundamental Charts for :