pool ads

pool adsOil Price Spike Lifts Chevron Corporation (NYSE:CVX) and Exxon Mobil Corporation (NYSE:XOM)

They are talking about today's early weakness n terms of the Presidential Debate, and the OPEC meeting, but none of that is news that anyone knows or that anyone is really concerned with. What we are really seeing here is the post-FOMC honeymoon ending.

The Market seems to be coming back into reality after what seemed like another round of rather irrational buying last week. It's not unusual for investors who want to sell to wait until the following week after a major run to do so, so in my opinion the rationale given in the media for today's weakness so far is misleading. The Market is weak today because it has been too strong lately, and investors are more willing to price it properly with the Post-FOMC run in the rear view mirror.

With that said, buyers still linger, and if selling pressure abates, which it absolutely can do, the market can bid right back up, maybe not all the way, but close, so the question begs itself, what could influence tat in the face of today's selling so far?

The answer is dovish FOMC speeches. Tarullo speaks at Yale at 11:45. The negative sentiment that exists now can start to turn as that approaches.

That can set up a very volatile yet not technically driven day. The channels are changing across the board, and after today we are likely to see different near and midterm channels. Right now I am unsure what they will look like, other than to say that the up-channels that were there are breaking, the door is open for further declines over time, and the net bias we have should remain bearish over time as a result, but this market can bounce higher and relatively aggressively so on an intraday basis today, so don't plug your nose.

Chevron Corporation (NYSE:CVX) and Exxon Mobil Corporation (NYSE:XOM) both spiked about 1% as hopes from the OPEC meeting sent WTI higher, and the market's reacted to that as well, but again this news will not be official for 2 additional days, and as we have said a deal is unlikely right now.

Technical Summary

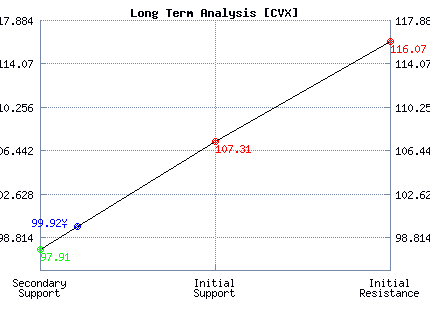

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Neutral | Neutral |

| P1 | 98.26 | 95.45 | 97.91 |

| P2 | 99.38 | 99.48 | 107.31 |

| P3 | 100.93 | 103.13 | 116.07 |

Support and Resistance Plot Chart for CVX

Long Term Trading Plans for CVX

September 26, 2016, 10:50 am ET

The technical Summary and associated Trading Plans for CVX listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for CVX. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

CVX - (Long) Support Plan

Buy over 97.91 target 107.31 stop loss @ 97.65.

The technical summary data tells us to buy CVX near 97.91 with an upside target of 107.31. This data also tells us to set a stop loss @ 97.65 to protect against excessive loss in case the stock begins to move against the trade. 97.91 is the first level of support below 99.92 , and by rule, any test of support is a buy signal. In this case, support 97.91 would be being tested, so a buy signal would exist.

CVX - (Short) Resistance Plan

Short under 107.31 target 97.91 stop loss @ 107.57.

The technical summary data is suggesting a short of CVX as it gets near 107.31 with a downside target of 97.91. We should have a stop loss in place at 107.57 though. 107.31 is the first level of resistance above 99.92, and by rule, any test of resistance is a short signal. In this case, if resistance 107.31 is being tested, so a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial