pool ads

pool adsSecure gains from ProShares UltraShort QQQ (ETF) (NYSEARCA:QID)

Stock Traders Daily has recommended to clients that they close positions in ProShares UltraShort QQQ (ETF) (NYSEARCA:QID) in association with the rules governing our Alerts Viewer Strategy.

According to our observations the market declines that were taking place on Tuesday have the ability to reverse themselves and if they do the market can stage a rally beyond Monday's highs and possibly higher, and if that happens we do not want to maintain QID positions.

This trading operation is being made in conjunction with defined support levels that the market was testing on Tuesday. The declines that took place on Tuesday brought the market back down to the support levels and if the market maintains the support levels it will have a high probability of increasing back to recent highs at least.

These support levels remain inflection and if they break bearish signals are going to prevail, but for now higher levels are suggested because those support levels are holding and although the chart patterns are neutral and not upward sloping the magnitude of the increase from support to resistance should one occur would be construed as bullish.

This trading recommendation was to secure gains from the double short ETF.

Additional recommendations can b found on our Strategy Pages.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Neutral | Neutral |

| P1 | 30.40 | 25.21 | 25.22 |

| P2 | 31.27 | 28.08 | 30.78 |

| P3 | 32.27 | 31.40 | 37.28 |

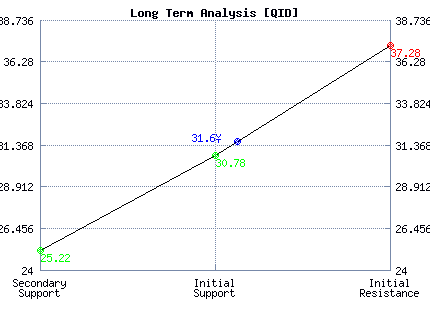

Support and Resistance Plot Chart for QID

Long Term Trading Plans for QID

May 3, 2016, 12:42 pm ET

The technical Summary and associated Trading Plans for QID listed below will help you make important timing decisions for your trades. This data is based on our proprietary analysis for QID. In addition we offer Market Timing Models and Stock Filters in the links above which may increase the proficiency of the decisions you make.

QID - (Long) Support Plan

Buy over 30.78 target 37.28 stop loss @ 30.52.

The technical summary data tells us to buy QID near 30.78 with an upside target of 37.28. This data also tells us to set a stop loss @ 30.52 to protect against excessive loss in case the stock begins to move against the trade. 30.78 is the first level of support below 31.6 , and by rule, any test of support is a buy signal. In this case, support 30.78 is being tested, a buy signal would exist.

QID - (Short) Resistance Plan

Short under 37.28 target 30.78 stop loss @ 37.54

The technical summary data is suggesting a short of QID as it gets near 37.28 with a downside target of 30.78. We should have a stop loss in place at 37.54 though. 37.28 is the first level of resistance above 31.6, and by rule, any test of resistance is a short signal. In this case, if resistance 37.28 is being tested, a short signal would exist.

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial