pool ads

pool adsValuation analysis for Akamai Technologies, Inc. (NASDAQ:AKAM)

We should appreciate fast growing companies, we may even want to invest in them, but that in no way suggests that we should be willing buyers of those companies at any price. This article defines the fair value of Akamai Technologies, Inc. (NASDAQ:AKAM) as that relates specifically to earnings growth as that is expected in the years ahead. Our earnings growth model considers the PE multiple and peg ratio to determine whether or not Akamai Technologies is an attractive value for investors at this time.

To begin, our evaluation of earnings growth comprises complete earnings cycles to avoid seasonal anomalies and we exclude onetime events to focus on truer earnings growth. We also do not believe that forward looking estimates that look beyond two years are reliable because we have found earnings expectations to change dramatically not only over multiyear timeframes, but sometimes even between quarters. Looking ahead two years seems reasonable, but beyond that is not in our opinion.

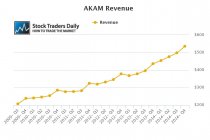

Although our model does not include revenue specifically, it is important for us to point out that revenue growth at Akamai has been exceptional. It is steady, consistent, and growing. Those are very attractive qualities for investors.

Recent earnings growth has also been solid, as noted in our yearly earnings growth graph for Akamai Technologies. As of the most recent release Akamai Technologies has been growing at 16.27%, which is a very nice growth rate, but that is expected to decline slightly this year if analysts are correct. The first red dot in our yearly earnings growth graph represents estimates for calendar 2015, and if analysts are correct about their estimates the growth rate will decline slightly to 12.22%.

However, looking beyond 2015 and to 2016, the second red dot in our graph, we can see that earnings growth is expected to accelerate in 2016 and analysts are expecting earnings growth of 32.1%. That is a remarkable growth rate by all accounts, and it largely counters the lower growth rate expected in 2015.

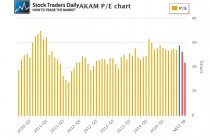

Our attention now turns to the PE multiple and the current PE multiple for Akamai Technologies is 29.05. This is represented by the blue bar in our PE chart, and we would consider it to be relatively rich, but if analysts are correct about their estimates for 2015 and the stock price remains the same that multiple is likely to decline to 26.44 by the end of 2015 and to 21.99 by the end of 2016 if analysts are right about that calendar year's earnings as well.

This combination of yearly earnings growth and our forward looking PE multiples allow us to identify fair value for Akamai Technologies at this time. Our peg ratio chart for Akamai Technologies shows us that the current peg ratio for Akamai is 1.79 and if analysts are correct about their estimates for 2015 that will increase to 2.19. Fair value for slow growing companies, according to our model, exists when a peg ratio is between zero and 1.5, but that boundary can be stretched for companies who are growing faster than normal. We would consider Akamai to be one of those companies who is growing faster than others, and therefore the relatively stretched PE ratio that exist now at 1.79 is not completely out of line with fair value, but as that peg ratio increases over 2, which is expected this year if analysts are correct about their estimates, we would consider values to begin to look rich.

The good news is, based on analysts' expectations for 2016 the valuation for Akamai improves considerably. In fact, the peg ratio declines below 1 to 0.69 at the end of 2016 if analysts are correct about their estimates and price remains the same.

So that brings our attention to price. Should price remain the same given the outlook for earnings and earnings growth specifically? For value oriented investors this is a very important question because it helps them determine whether or not they should be investing in Akamai Technologies at this time.

The first response to the question posed above is that the valuation that exist today will likely look more expensive as this year continues, if analysts are correct and price remains the same. That causes us to question the stocks ability to continue to move higher immediately if valuation metrics deteriorate, but clearly the following year looks better, so two years from now valuation will actually look quite attractive if analysts are correct.

In association with our real time trading report for AKAM, our concern is that the stock is not offering immediate value and runs the risk of declining by about 20% from current levels, so in our opinion value oriented investors should not chase this stock. Value oriented investors who are more aggressive by nature should consider Akamai Technologies on dips only.

Because valuation metrics look much more attractive in 2016 than they do in 2015 we would also expect the stock to pull back at some point during calendar 2015, probably sooner than later, but after it pulls back by 15 or 20% we would consider that to be relatively attractive for value oriented investors if the 2016 estimates remain the same. At current levels we would not consider the stock to be attractive for value oriented investors given the declining valuation metrics expected this year.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :