pool ads

pool adsValuation analysis for Adobe Systems Incorporated (NASDAQ:ADBE)

Sometimes investors get caught up in news and promises made by company executives and they take their eyes off of the ball. They stop paying attention to the fundamentals, and sometimes that can lead to disaster.

To most investors, valuation is extremely important, but thus far valuation is not nearly as important for investors in Adobe Systems Incorporated (NASDAQ:ADBE) as you might think. Eventually, stocks which are significantly undervalued or overvalued usually come back into parity with their fair valuation, so this observation serves as a guideline for the fair value of Adobe specifically.

First of all, earnings at Adobe have been declining aggressively since the third quarter of 2012. The most recent result was lower than at any other point since 2009, and although revenues are still at 2011 levels they have also come down from their respective peak and revenue growth does not currently exist either. This brings our attention to earnings growth specifically.

Our observations of earnings growth focuses on earnings from operations and discounts onetime events to better define actual growth, and then we compile trailing 12 month data and compare that on a yearly basis to develop our yearly growth rate chart. Our observations suggest that Adobe, although still experiencing a contraction in EPS of about 8.6%, is not deteriorating as fast as it was about a year ago.

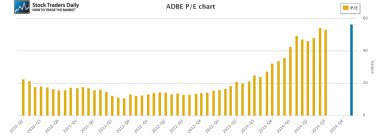

However, and most interestingly, the PE multiple for Adobe is really what tells the story. At the same time earnings began to decline significantly, which was the third quarter of 2012, the multiple began to expand. The PE multiple for Adobe went from near 15 times earnings to 56 times earnings, an almost fourfold increase, while both earnings and revenue experienced contraction.

Technical take:

According to our real time trading report for Adobe the stock tested longer term support when the market fell hard about a month ago, and it has been increasing towards longer term resistance ever since. The stock has not tested longer-term resistance but it appears to be in the process of increasing towards that resistance level. On a technical basis, we would not be buyers of Adobe, but instead look to sell or short the stock when resistance is tested.

Summary:

Adobe is extremely overvalued, the PE multiple of 56 times earnings levied on the stock at this time is not supported by either earnings growth or revenue growth, and eventually we believe multiple contractions could hit this stock and cause it to come into parity with its actual growth rate. We would not be buyers of Adobe but instead look to sell or short the stock when triggers surface.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :