pool ads

pool adsValuation analysis for Advance Auto Parts, Inc. (NYSE:AAP)

Some companies look better than others, and as an investor it is important for us to determine which is which. This article and the 'Valuation Series' of articles by Stock Traders Daily attempts to answer those questions and reveal opportunity for investors accordingly.

Advance Auto Parts, Inc. (NYSE:AAP) has had a recent surge in both earnings and revenue and although the most recent quarter showed a moderate pullback after that significant increase both earnings and revenue growth are still considerably higher than they were a year ago. Our evaluation of Advanced Auto Parts reveals what appears to be not only the fair valuation but possibly a buy signal for the stock is well.

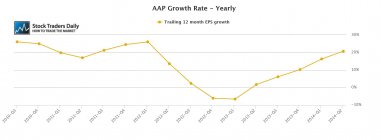

Our evaluation of EPS growth focuses on earnings from operations and excludes onetime events that may not be related to the business of the company itself. We use combined trailing 12 month data and evaluate that on a yearly basis to determine yearly growth rates, and our evaluation of Advanced Auto Parts reveals the yearly growth rate of 20.73%. This is a solid growth rate.

Appropriately, the stock also trades with a PE multiple of 21.7x earnings. At face value this is a relatively high PE multiple, but when we compare that to earnings growth the PE multiple does not look nearly as rich. In fact, the peg ratio for Advanced Auto Parts is a reasonable 1.06.

Our paid ratio evaluation is based on the same yearly growth criteria as mentioned above, and when peg ratios are at or about 1 we consider that to be relatively attractive so long as companies can maintain their growth rate. There is, of course, the question yet to be answered.

Technical take:

According to our real time trading report for Advanced Auto Parts the stock is currently breaking above longer term resistance and that is a bullish sign. Longer term resistance has been converted into support because the stock is beginning to break out and so long as the stock remains above this level we would consider it a buy with upside targets yet to be determined. Therefore, not only is the former level of longer-term resistance that has been converted into support a buy signal, but it also acts as our risk control. If the stock falls back below this level again we would get out of the trade.

Summary:

Advanced Auto Parts is growing solidly, and although the PE ratio is relatively high its growth rate is as well and on a fundamental basis the stock appears to be fairly valued. If the stock can maintain its growth rate it will be extremely attractive according to our combined analysis because the peg ratio is barely above 1. Given the break above longer term resistance that seems to be happening at this time we would recommend buying Advanced Auto Parts so long as the stock can hold is converted longer term support level. Importantly, we would only be buyers near this converted support level as well, and we will use that as our risk control and exit the trade if it breaks.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :