pool ads

pool adsValuation analysis for Alcoa Inc (NYSE:AA)

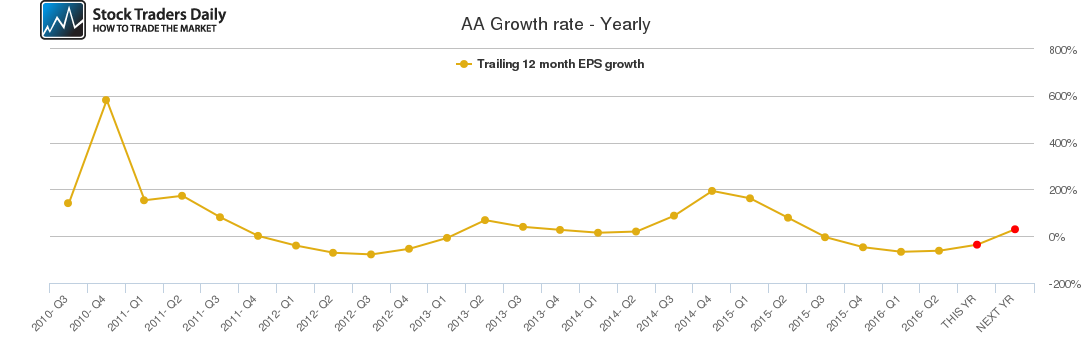

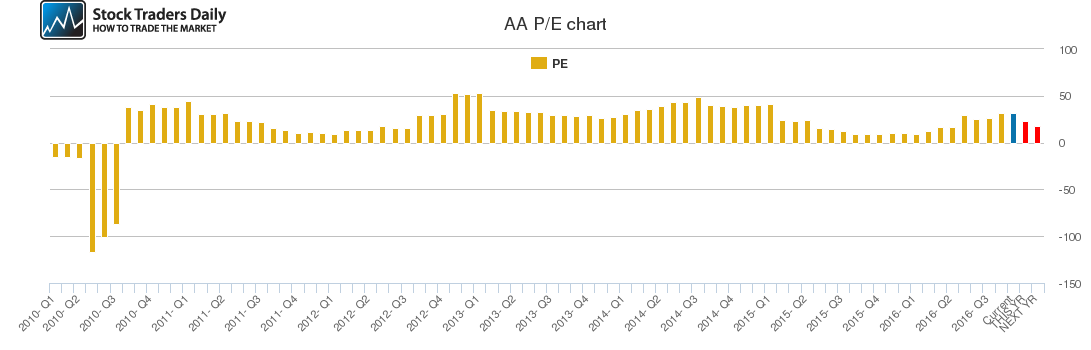

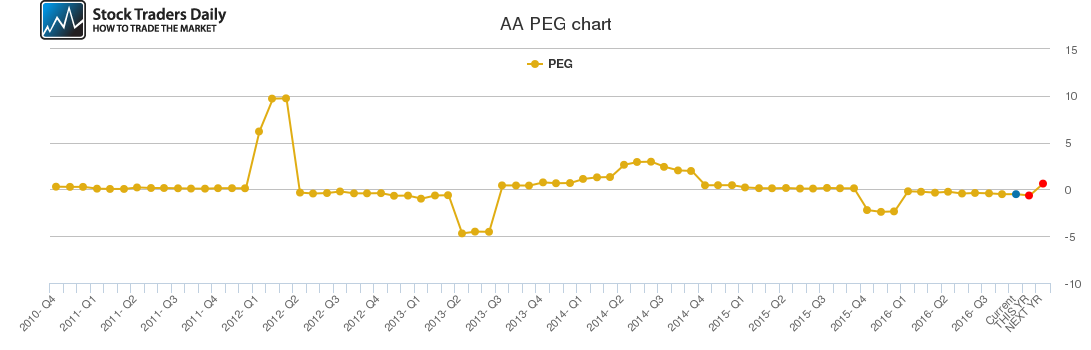

Based on a valuation metric that compares earnings growth for Alcoa Inc (NYSE:AA) to PE multiples, Stock Traders Daily recognizes recently declining EPS growth rates but also expects earnings growth to increase aggressively between 2016 and 2017 and that will make the current multiple look much more reasonable than it does today.

That should reduce the multiple to a 17-handl at the end of 2017 if price remains the same, but 2015 multiples look hard to come by unless the stock falls again. Technically, that could happen, but upside potential outweighs downside risk in he charts.

Want Trading Advice for AA? Sign up for a Trial to Stock Traders Daily

Support and Resistance Plot Chart for AA

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial