pool ads

pool adsValuation analysis for Autodesk, Inc. (NASDAQ:ADSK)

When earnings decline in the face of increasing revenue the first thing that comes to mind is margin pressure. This is not always true, sometimes companies can redirect revenues towards growth instead, but eventually those companies need to bring those added revenues to the bottom line to satisfy shareholders.

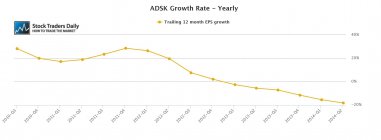

Our observations of Autodesk, Inc. (NASDAQ:ADSK) suggest that earnings growth is declining while revenue is increasing. This diverging relationship has been quite clear since the third quarter of 2013, and although the company still has time to prove that it can bring those added revenues to the bottom line, it has not done that yet.

Instead, as earnings growth turned negative the stock accelerated and the PE multiple increased from near 18 times earnings, where it was when this divergence began in the third quarter of 2013, to over 40 times earnings, where it stands today. The multiple expansion associated with Autodesk took place as earnings growth declined, and that raises concerns for investors looking to identify fair valuation.

Technical take:

According to our real time trading report for Autodesk the stock is in the process of increasing towards longer term resistance and reasonably longer-term resistance is within striking distance; t is much closer than longer term support, suggesting that the downside risk in the stock outweighs the upside potential at this time. Because the stock is in the upper tier of its trading channel we would not suggest buying the stock at this level, but instead recommend protecting gains given the proximity to longer term resistance.

Summary:

The diverging relationship between revenue and earnings growth at Autodesk makes it extremely overvalued based on fundamental observations that are based on earnings growth as that relates to PE multiples, and any doubt about that basic fundamental observation can only be made if the diverging relationship between revenue and earnings growth is not related to margin pressure. In addition, it is absolutely clear that Autodesk will need to bring revenues to the bottom line and produce substantial EPS growth in the year ahead to satisfy investors, otherwise, in our opinion, the massive multiple expansion that took place recently will reverse. This suggests that investors who are holding onto Autodesk protect those gains and given the aggressive increase that has happened recently and the proximity of the stock to longer-term resistance our technical analysis supports the same.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :