pool ads

pool adsValuation analysis for The Walt Disney Company (NYSE:DIS)

Stock Traders Daily is in the process of publicly disclosing its determination of the fair value for the dow Jones industrial average, one component at a time. The combined result has already been provided to clients of Stock Traders Daily. The fundamental fair valuation analysis below is one of 30.

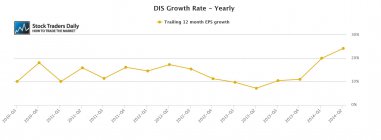

Earnings growth for The Walt Disney Company (NYSE:DIS) has been fantastic! When we review earnings growth we use trailing 12 month EPS Data that excludes onetime events. According to our analysis Disney is growing by about 24% based on the last report. This is fantastic, and that growth rate is supported by an increase in revenue as well. This combination is extremely positive for investors looking for growth.

Going forward, analysts are not expecting the growth rate to be that robust, they are expecting a growth rate closer to 10%, so given that adjusted expectation it is important for us to recognize fair value for Disney at these levels.

First, given the current growth rate when compared to the PE multiple, which is just above 20 times earnings, the peg ratio for Disney is less than 1, at 0.86. If DIS continued to grow at its current rate it would be significantly undervalued at current levels, but analysts are expecting slower growth, so let's factor that in.

With a growth rate at about half of what it has been recently the peg ratio would increase from 0.86 to about 1.7. Given the solid growth rate that Disney has experienced, that would not be an unreasonable valuation level, so everything considered Disney appears to be fairly valued on a fundamental basis at this time.

Technical take:

According to our real time trading report for Disney the stock has recently tested longer term support and it has already begun to turn higher. Our observations suggest that the stock is already in the process of increasing towards longer term resistance at this time and so long as support remains intact we would expect it to continue towards longer term resistance. We would not be buyers of the stock, however, because the stock is well above support and we prefer to buy stocks at support, not in the middle of trading channels. Support should also act as your risk control in this position, and if support breaks anyone who bought near support should exit the position.

Summary:

The impressive growth rate for Disney is not expected to continue at the same pace going forward, but growth is still expected to be solid. Given the adjusted forward looking growth rates the peg ratio is still at a reasonable level, making DIS appear to be fairly valued at this level, but the buy signals occurred last week when the stock was much lower and we would not be buyers of the stock at this price as a result.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :