pool ads

pool adsValuation analysis for UnitedHealth Group Inc. (NYSE:UNH)

In order to know why the market is volatile you must understand what the fair value of the market is, and although Stock Traders Daily has provided this information in summarized format to clients already, it is also releasing fair value analysis publicly for each of the 30 Dow components to help investors understand the same.

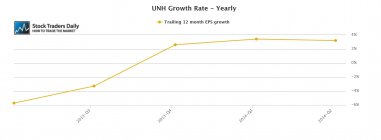

UnitedHealth Group Inc. (NYSE:UNH) appears to be a company that is growing endlessly, some people think there's no end in sight, but recently EPS growth has slowed considerably and that is concerning. When reviewing EPS growth we focus on trailing 12 month EPS Data that excludes onetime events. When we compare the data on a yearly basis to determine yearly growth rates this analysis for United Healthcare Group reveals earnings growth of 3.21%.

Furthermore, earnings have been suffering over the past few quarters, given this yearly growth analysis, but revenues continue to increase and most observers believe that the company can get itself right back on track again. This positive bias has kept the stock in an upward trend, but valuation concerns absolutely exist.

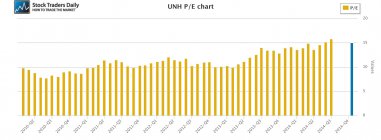

With a PE multiple just over 15 times earnings, the peg ratio for United Healthcare Group is 4.69. That is extremely rich, and if the company continues to grow earnings at such a slow pace, like it has in the last handful of quarters, valuation concerns will begin to surface and the stock will likely experience multiple contractions until the PE multiple hits near 10 again, a level more consistent with its average.

Technical take:

According to our real time trading report for UNH, United Healthcare Group has recently tested longer term support and thus far longer term support is holding. By rule, we should expect longer term support levels to remain intact unless they break, and if longer term support remains intact we should also expect a progression towards longer-term resistance levels. Longer term support acts as our risk control, if it breaks we should stop out of any position in United Healthcare Group, but for now technical buy signals exist with an upside target of longer-term resistance, with longer term support as our risk control.

Summary:

There definitely are reasons to doubt the sustainability of the stock price of United Healthcare Group given the recent slow yearly growth rate. The stock has not yet broken trend, however, and because price is the most important factor in making money in the stock market, we must respect that. That means that based on price United Healthcare Group is a buy near longer term support levels, but if the stock breaks below longer term support as we have defined it in our report we would be Sellers immediately and we would consider that to be a sign that valuation risks are increasing.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :