September 27, 2021, 03:45 am ET, BY Thomas H. Kee Jr - Editor, Stock Traders Daily |

Editor: Thomas H. Kee Jr. (Follow on LinkedIn)

This

Autodesk (NASDAQ: ADSK) trading report incorporates analysis also used by some of the biggest funds in the world. Review the technical takeaways closely.

Warning:

This is a static report, the data below was valid at the time of the publication, but support and resistance levels for ADSK change over time, so the report should be updated regularly. Real Time updates are provided to subscribers. Unlimited Real Time Reports.

Subscribers also receive market analysis, stock correlation tools, macroeconomic observations, timing tools, and protection from market crashes using Evitar Corte.

Instructions:

The rules that govern the data in this report are the rules of Technical Analysis. For example, if ADSK is testing support buy signals surface, and resistance is the target. Conversely, if resistance is being tested, that is a sign to control risk or short, and support would be the downside target accordingly. In each case, the trigger point is designed to be both an ideal place to enter a position (avoid trading in the middle of a trading channel), and it acts as a level of risk control too.

Swing Trades, Day Trades, and Longer term Trading Plans:

This data is refined to differentiate trading plans for Day Trading, Swing Trading, and Long Term Investing plans for ADSK too. All of these are offered below the Summary Table.

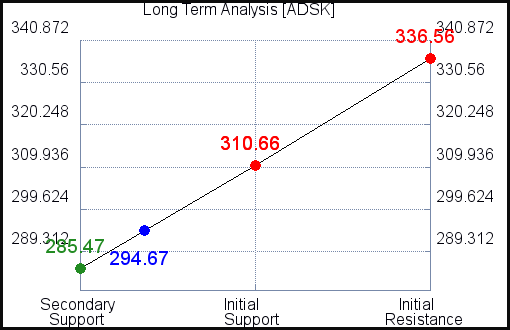

Longer Term Trading Plans for ADSK

- Buy ADSK slightly over 285.47 target 310.66 stop loss @ 284.65 Details

The technical summary data tells us to buy ADSK near 285.47 with an upside target of 310.66. This data also tells us to set a stop loss @ 284.65 to protect against excessive loss in case the stock begins to move against the trade. 285.47 is the first level of support below 294.67 , and by rule, any test of support is a buy signal. In this case, support 285.47 would be being tested, so a buy signal would exist.

- Short ADSK under 310.66, target 285.47, stop loss @ 311.56 Details

The technical summary data is suggesting a short of ADSK as it gets near 310.66 with a downside target of 285.47. We should have a stop loss in place at 311.56though. 310.66 is the first level of resistance above 294.67, and by rule, any test of resistance is a short signal. In this case, if resistance 310.66 is being tested, so a short signal would exist.

Swing Trading Plans for ADSK

- Buy ADSK slightly over 310.66, target 336.56, Stop Loss @ 309.76 Details

If 310.66 begins to break higher, the technical summary data tells us to buy ADSK just slightly over 310.66, with an upside target of 336.56. The data also tells us to set a stop loss @ 309.76 in case the stock turns against the trade. 310.66 is the first level of resistance above 294.67, and by rule, any break above resistance is a buy signal. In this case, 310.66, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short ADSK near 310.66, target 293.13, Stop Loss @ 311.56. Details

The technical summary data is suggesting a short of ADSK if it tests 310.66 with a downside target of 293.13. We should have a stop loss in place at 311.56 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 310.66, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

Day Trading Plans for ADSK

- Buy ADSK slightly over 296.75, target 310.66, Stop Loss @ 296.06 Details

If 296.75 begins to break higher, the technical summary data tells us to buy ADSK just slightly over 296.75, with an upside target of 310.66. The data also tells us to set a stop loss @ 296.06 in case the stock turns against the trade. 296.75 is the first level of resistance above 294.67, and by rule, any break above resistance is a buy signal. In this case, 296.75, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short ADSK near 296.75, target 293.13, Stop Loss @ 297.44. Details

The technical summary data is suggesting a short of ADSK if it tests 296.75 with a downside target of 293.13. We should have a stop loss in place at 297.44 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 296.75, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

ADSK Ratings for September 27:

| Term → | Near |

Mid |

Long |

|---|

| Rating |

Strong |

Weak |

Strong |

| P1 |

0 |

0 |

285.47 |

| P2 |

290.81 |

284.42 |

310.66 |

| P3 |

296.75 |

293.13 |

336.56 |

⚠Triggers may have already come

Support and Resistance Plot Chart for ADSK

Blue = Current Price

Red = Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for ADSK: