pool ads

pool adsEPS Declines but Stock Market Surges $GS $BLK $WFC

Financials surge on Lower EPS Growth

The Market responds oddly sometimes to lower growth rates, and where normally lower growth would imply a negative reaction, sometimes stocks increase instead. The rationale for this is inconsistent, and it could be as simple as the stocks have been beaten up and lower growth rates are priced in already, but the Financial stocks below that seemed to influence the rally are not exactly beaten up.

Here are the facts re Financials so far:

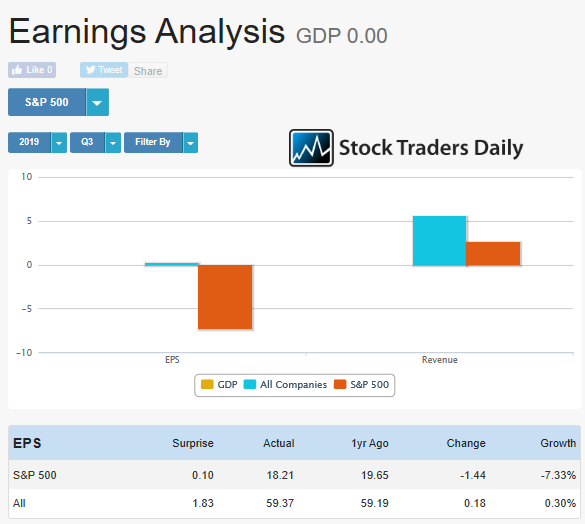

- EPS declined by 7.33%

- Revenue increased by 2.62%

- Upon release, S&P 500 increased by 30 points on Tuesday.

The data offered below comes directly from our EPS Analysis Page, where we allow filtering and sorting to review actual combined EPS and Revenue Growth. What we have found is that the surge in the stock market was not validated by the decline in EPS.

Review the Earnings Analysis Page yourself and use the Raw Data link at the bottom to filter and sort, and back test too if needed (long term data is available). You will see this as well.

|

Company |

SYM |

Sector |

EPS Change |

EPS Growth |

Revenue Growth |

|

Goldman Sachs |

GS |

Financials |

-1.49 |

-23.73% |

-3.77% |

|

BlackRock |

BLK |

Financials |

-0.37 |

-4.92% |

3.24% |

|

Wells Fargo |

WFC |

Financials |

-0.21 |

-18.58% |

0.31% |

|

Charles Schwab |

SCHW |

Financials |

0.05 |

7.69% |

5.12% |

|

Citigroup |

C |

Financials |

0.24 |

13.87% |

1.01% |

|

JPMorgan Chase |

JPM |

Financials |

0.34 |

14.53% |

7.48% |

In the image below we have filtered the results to include JUST the Financials. The text related to the orange bars reads ‘S&P 500’ but the display represents the six financial stocks above. This shows us that earnings growth for these companies declined by 7.33%.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :