pool ads

pool adsHow to trade Proshares Ultra Gold $UGL With Risk Controls

Price matters most to making money in the market. Celebrating 20 years, Stock Traders Daily provides the tools that help you develop investment strategies, and this is a good example. When we couple this with our market based analysis, the probabilities of going with the flow increases, and that is material over time. The Proshares Ultra Gold (NYSE: UGL) report below can help you, but we have more details too. The trading plans for UGL, and the other 1000+ stocks we follow, are updated in real time for subscribers, but this report is static. If you want an update, or a different report, please get one here Unlimited Real Time Reports.

Technical Summary

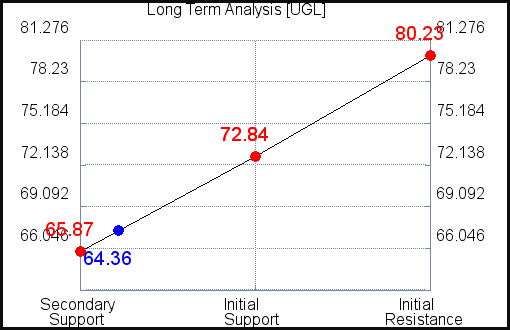

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Weak | Neutral | Strong |

| P1 | 0 | 0 | 65.87 |

| P2 | 63.61 | 60.26 | 72.84 |

| P3 | 65.00 | 64.02 | 80.23 |

Support and Resistance Plot Chart for UGL

Long Term Trading Plans for UGL

January 24, 2021, 6:30 pm ET

The Technical Summary and Trading Plans for UGL help you determine where to buy, sell, and set risk controls. The data is best used in conjunction with our Market Analysis and Stock Correlation Filters too, because those help us go with the flow of the market as well. Going with the flow is extremely important, so review our Market Analysis with this UGL Report.

UGL - (Long) Support Plan

There is no current Support Plan to trigger a buy of this stock at this time. This usually means that there are no clear support levels at this time, so buying the stock as it falls could be considered catching a falling knife. Buy signals only exist if resistance breaks higher.

This often is a signal that the stock you are watching is weak. Waiting for a turn higher may be more intelligent than trying to catch a falling knife. In any case, new support levels are usually revised to the database at the beginning of the next trading session.

UGL - (Short) Resistance Plan

The technical summary data is suggesting a short of UGL as it gets near 65.87, but the downside target is not available from the current data. This tells us to hold that position if it is triggered until a new downside target has been established (updates occur at the beginning of every trading session) or until the position has been stopped. The summary data tells us to have a stop loss in place at 66.06. 65.87 is the first level of resistance above 64.36, and by rule, any test of resistance is a short signal. In this case, if resistance 65.87 is being tested, so a short signal would exist.