pool ads

pool adsValuation analysis for QUALCOMM, Inc. (NASDAQ:QCOM)

Stock Traders Daily has issued a valuation analysis of QUALCOMM, Inc. (NASDAQ:QCOM).

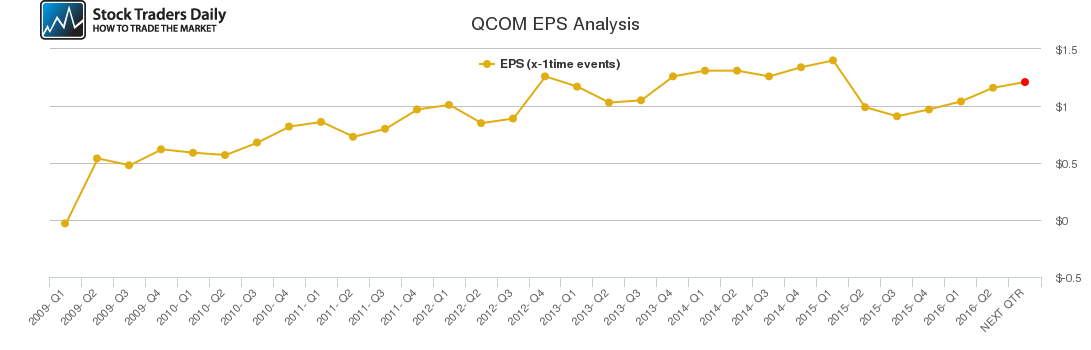

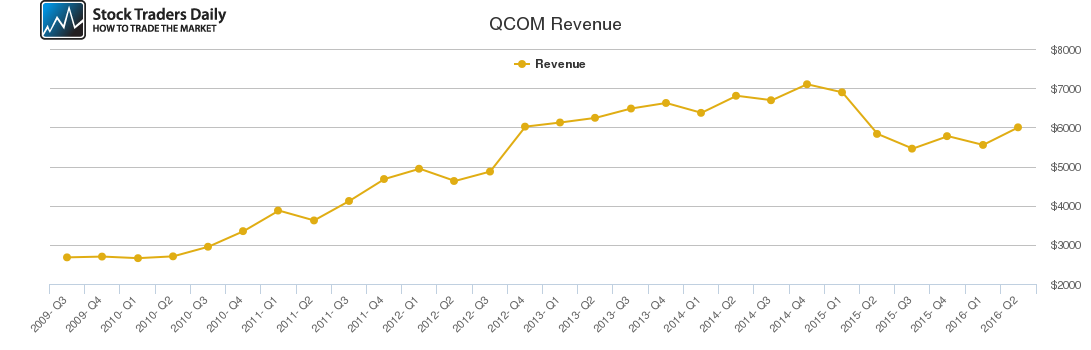

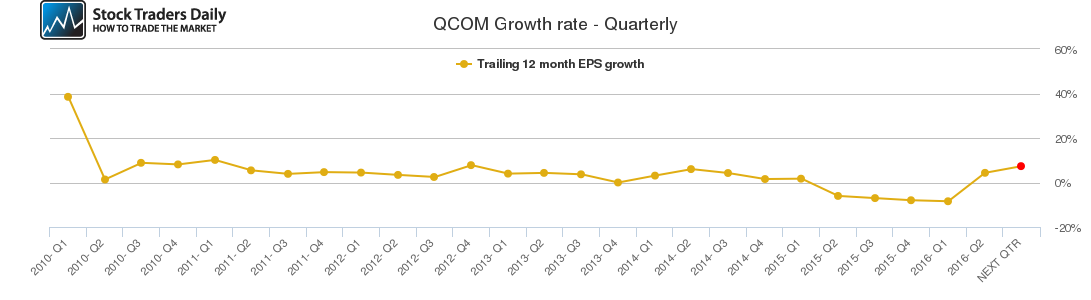

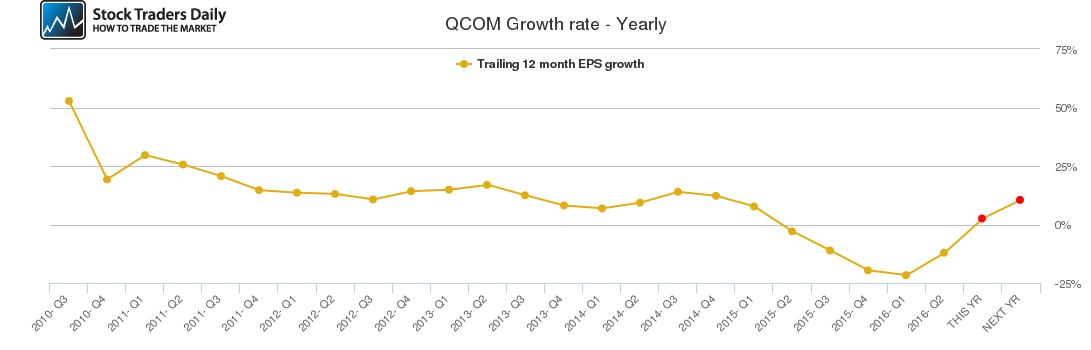

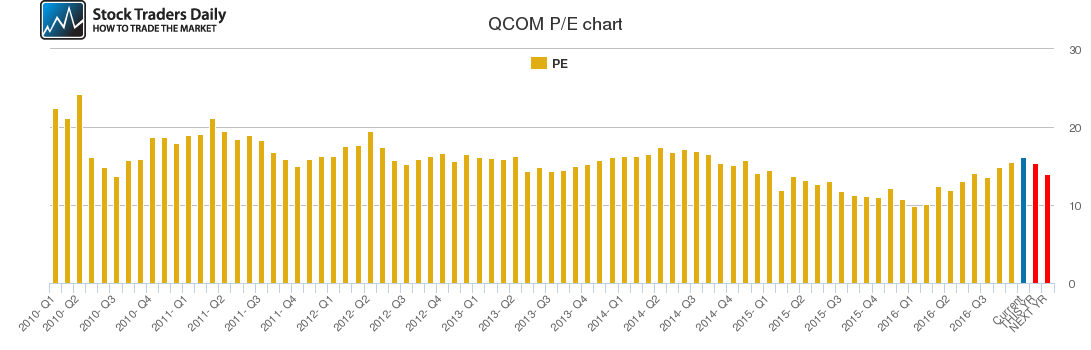

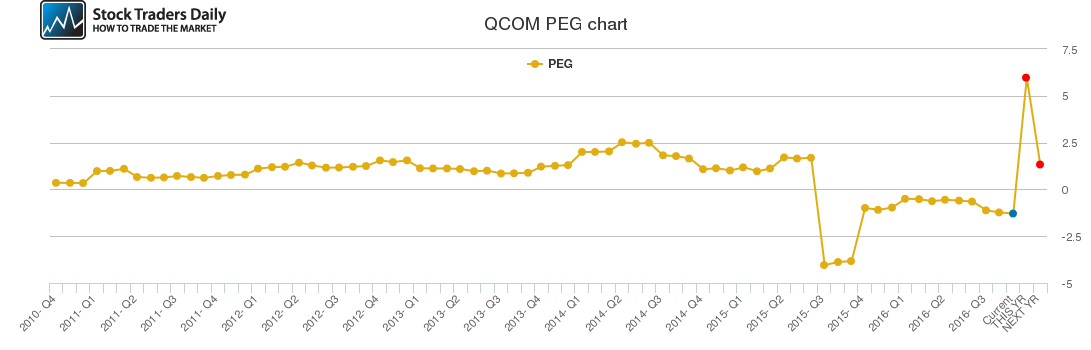

To begin, Qualcomm is expected to have a solid growth rate this year and next year, and the associated PE multiples that would exist if price remains the same are reasonable in both instances as well. The peg ratio for Qualcomm given this relationship is also within the range of fair valuation, suggesting that Qualcomm is fairly valued or possibly even undervalued at current levels.

The technicals largely support this thesis and the stock is bouncing off of technically defined support levels. If this continues we expect the stock to have follow through to the technically defined resistance levels. Additional details are available to subscribers.

Support and Resistance Plot Chart for QCOM

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial