pool ads

pool adsWill CPI Tank if EPS Declines for the Dow Jones Industrial Average?

The knee jerk reaction to the hotter than expected CPI data today was negative, but the S&P 500 (INDEXSP: .INX) has already recovered from the early dip. This is not surprising because the hotter data was not out of line with reasonable expectations.

Reasonably, hot inflation data should still be expected now, but if inflation is akin to the upcoming change in earnings growth rates for the market, the next installment of CPI will be tamer.

If the CPI data is this hot next time, it will be a more material concern.

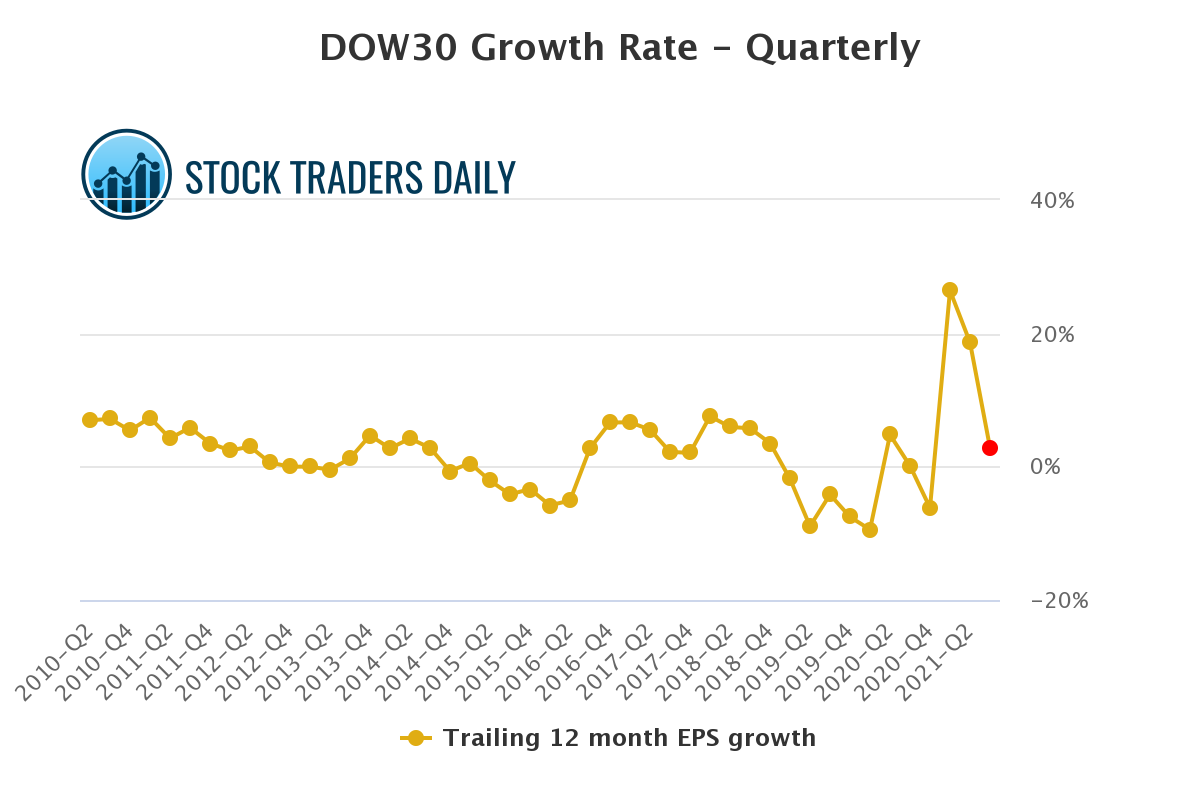

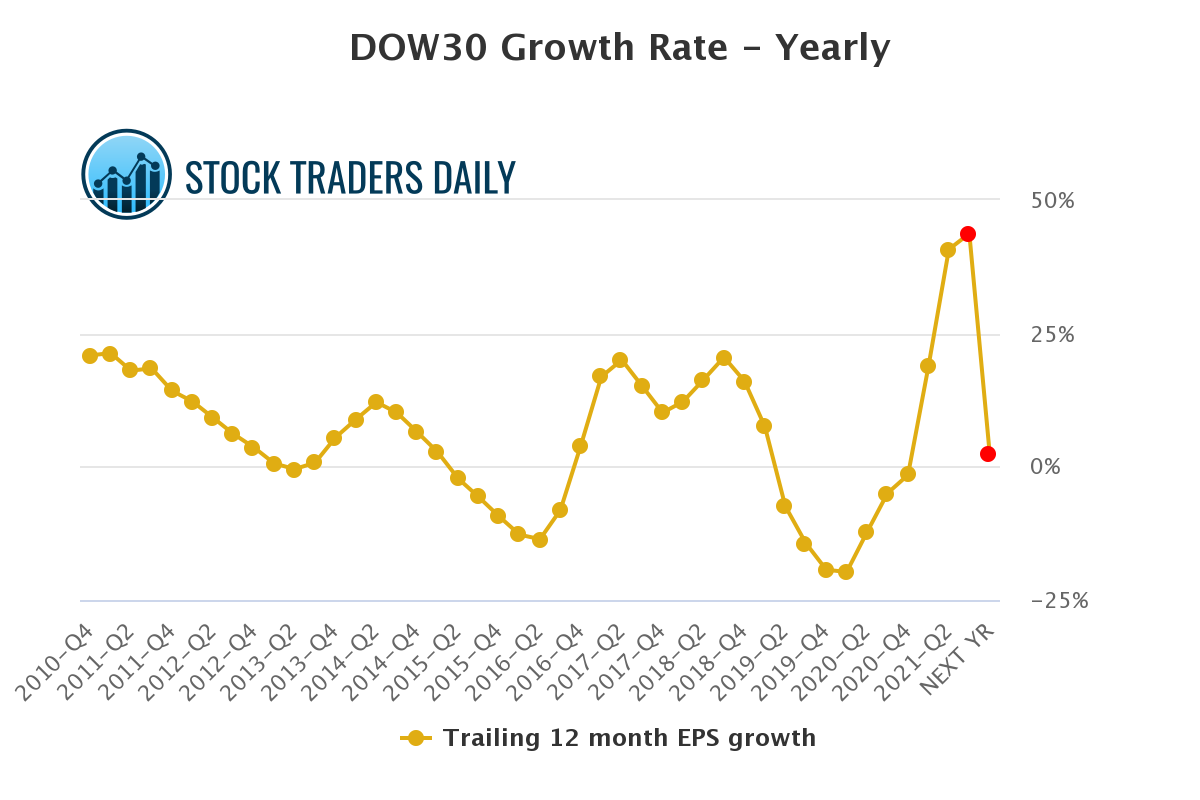

EPS declines for the Dow Jones Industrial Average (INDEXDJX: .DJI) begin next quarter, and continue through next year. Using the charts below, DJIA EPS growth tanks from an expected 18.6% this quarter, to 2.86% next quarter.

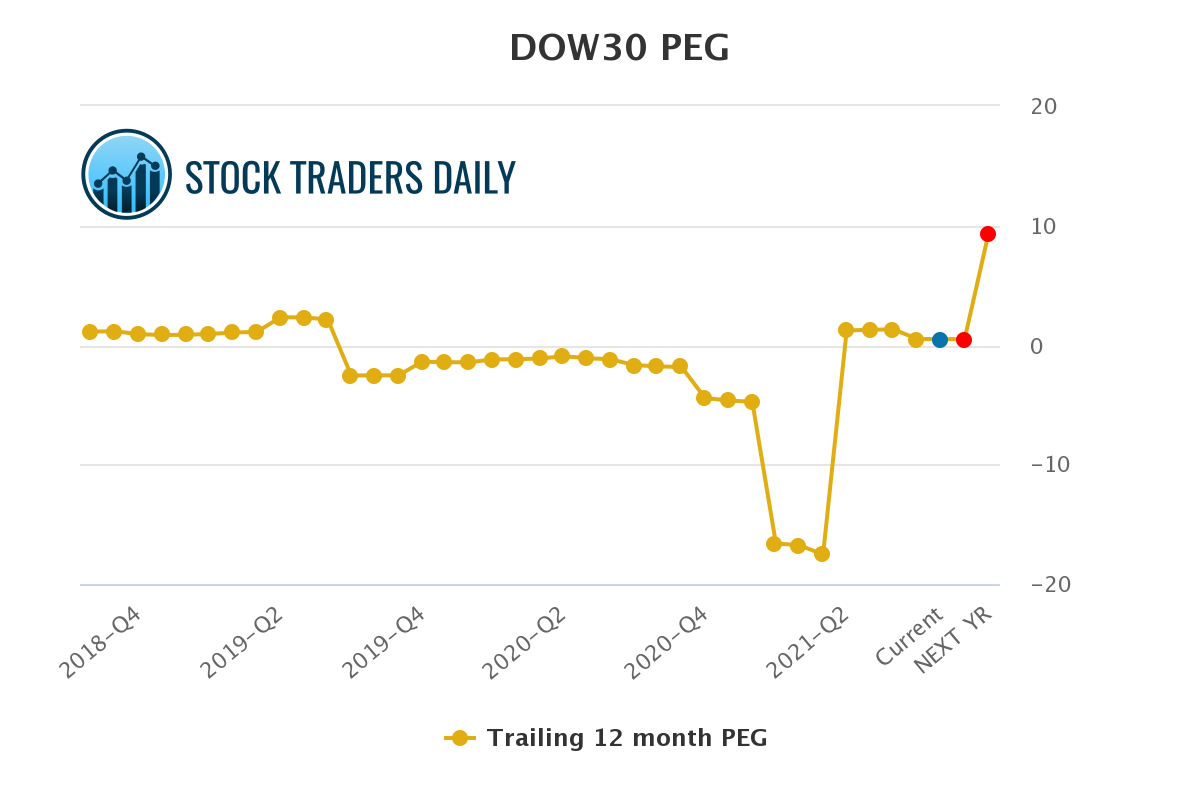

Additionally, if growth rates tank, valuations get stretched. Look at the PEG chart too.

Real Time Updates to this data is available at Stock Traders Daily

Support and Resistance Plot Chart for DJI

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial