Stock Analysis

Behavioral Patterns of SBUX and Institutional Flows

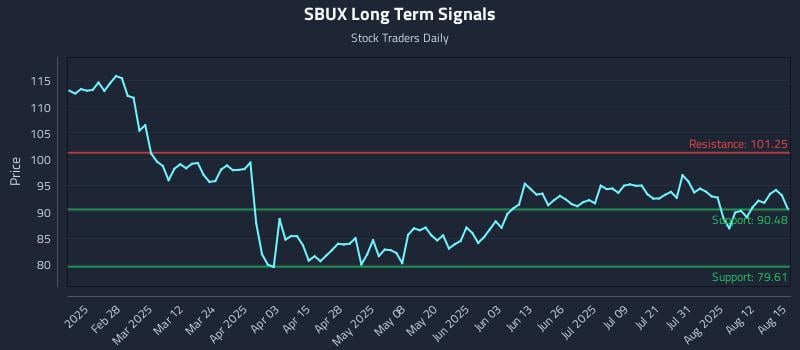

Key Findings

- Full Alignment in Neutral Sentiment Favors Wait-and-See Approach

- Price action tests key support at $90.48, offering favorable risk entry

- Exceptional 41.4:1 risk-reward setup targets 11.9% gain vs 0.3% risk

- Wide long-term range to $101.25 provides 11.9% upside runway

- AI pattern recognition identifies institutional accumulation footprint

Institutional Trading Strategies

Our AI models have generated three distinct trading strategies tailored to different risk profiles and holding periods. Each strategy incorporates sophisticated risk management parameters designed to optimize position sizing and minimize drawdown risk.

Position Trading Strategy

LONG

Entry Zone

$90.48

Target

$101.25

Stop Loss

$90.22

Momentum Breakout Strategy

BREAKOUT

Trigger

$91.01

Target

$91.47

Stop Loss

$90.76

Risk Hedging Strategy

SHORT

Entry Zone

$91.47

Target

$86.90

Stop Loss

$91.74

Multi-Timeframe Signal Analysis

| Time Horizon | Signal Strength | Support Signal | Resistance Signal |

|---|---|---|---|

| Near-term (1-5 days) | Neutral | $91.01 | $93.27 |

| Mid-term (5-20 days) | Neutral | $91.47 | $94.61 |

| Long-term (20+ days) | Neutral | $90.48 | $101.25 |

AI Generated Signals for SBUX

Blue = Current Price

Red = Resistance

Green = Support