Stock Analysis

Trading Systems Reacting to (COHU) Volatility

Key findings for Cohu Inc. (NASDAQ: COHU)

- Near-Term Strong Sentiment Could Begin to Challenge Persistent Mid and Long-Term Weakness

- Breakout is underway. If sustained, higher levels are expected.

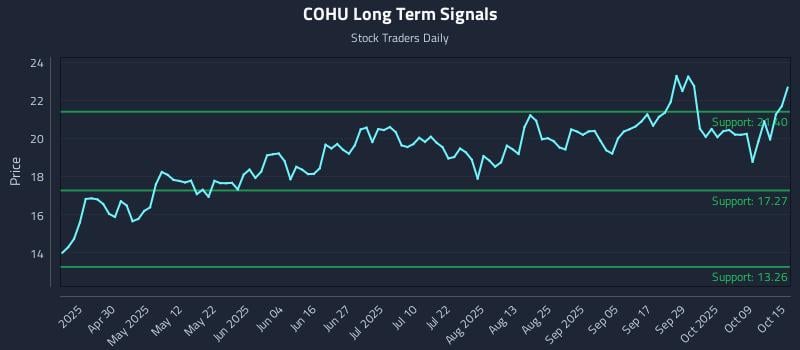

- Elevated downside risk as no additional long-term support signals remain.

- Signals: 13.26 · 17.27 · 21.40 · 22.69 (bold = current price)

- Weak Sentiment is prevailing thus far — See current SIGNALS for positioning and risk parameters.

Institutional Trading Strategies

Our AI models have generated three distinct trading strategies tailored to different risk profiles and holding periods. Each strategy incorporates sophisticated risk management parameters designed to optimize position sizing and minimize drawdown risk.

Position Trading Strategy

LONG

Entry Zone

$21.40

Target

$23.11

Stop Loss

$21.34

Momentum Breakout Strategy

BREAKOUT

Trigger

$22.69

Target

$23.14

Stop Loss

$22.63

Risk Hedging Strategy

SHORT

Entry Zone

$22.69

Target

$21.56

Stop Loss

$22.76

Multi-Timeframe Signal Analysis

| Time Horizon | Signal Strength | Support Signal | Resistance Signal |

|---|---|---|---|

| Near-term (1-5 days) | Strong | $21.54 | $22.28 |

| Mid-term (5-20 days) | Weak | $20.06 | $21.52 |

| Long-term (20+ days) | Weak | $17.27 | $21.40 |

AI Generated Signals for COHU

Blue = Current Price

Red = Resistance

Green = Support