Stock Analysis

Precision Trading with Exxon Mobil Corporation (XOM) Risk Zones

Key findings for Exxon Mobil Corporation (NYSE: XOM)

- Neutral Sentiment in Near Term Could Moderate Mid-Term Weakness

- Lower range position offers 5.4% upside to resistance target

- Exceptional 22.1:1 risk-reward setup targets 6.5% gain vs 0.3% risk

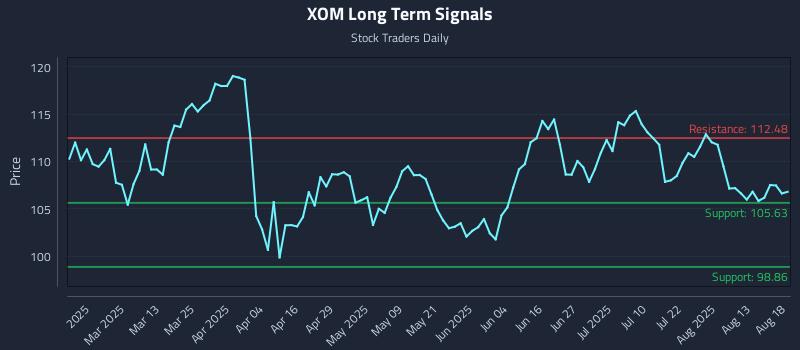

- Signals: 98.86 · 105.63 · 106.77 · 112.48 (bold = current price)

- Weak Sentiment Dominates 1 of 3 Horizons — See current SIGNALS for positioning and risk parameters.

Institutional Trading Strategies

Our AI models have generated three distinct trading strategies tailored to different risk profiles and holding periods. Each strategy incorporates sophisticated risk management parameters designed to optimize position sizing and minimize drawdown risk.

Position Trading Strategy

LONG

Entry Zone

$105.63

Target

$112.48

Stop Loss

$105.32

Momentum Breakout Strategy

BREAKOUT

Trigger

$107.23

Target

$112.48

Stop Loss

$106.93

Risk Hedging Strategy

SHORT

Entry Zone

$112.48

Target

$106.86

Stop Loss

$112.82

Multi-Timeframe Signal Analysis

| Time Horizon | Signal Strength | Support Signal | Resistance Signal |

|---|---|---|---|

| Near-term (1-5 days) | Neutral | $106.27 | $107.23 |

| Mid-term (5-20 days) | Weak | $103.58 | $106.34 |

| Long-term (20+ days) | Neutral | $105.63 | $112.48 |

AI Generated Signals for XOM

Blue = Current Price

Red = Resistance

Green = Support