November 27, 2024, 10:28 am ET, BY Bill - Contributor |

Editor: Thomas H. Kee Jr. (Follow on LinkedIn)

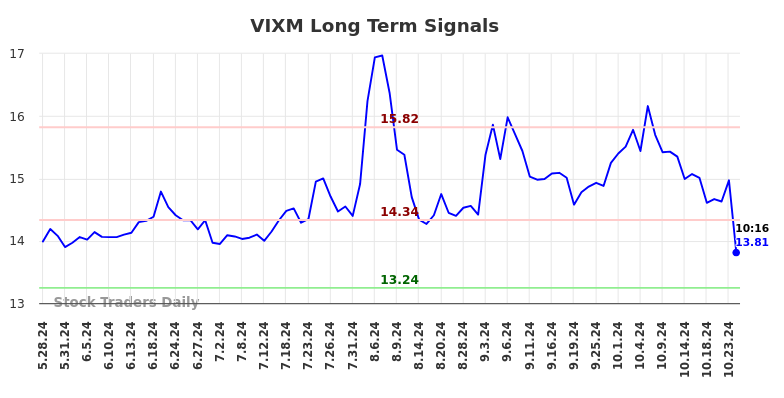

Longer Term Trading Plans for VIXM

- Buy VIXM near 13.24 target 14.34 stop loss @ 13.2 Details

The technical summary data tells us to buy VIXM near 13.24 with an upside target of 14.34. This data also tells us to set a stop loss @ 13.2 to protect against excessive loss in case the stock begins to move against the trade. 13.24 is the first level of support below 13.84 , and by rule, any test of support is a buy signal. In this case, support 13.24 would be being tested, so a buy signal would exist.

- Short VIXM slightly under 14.34, target 13.24, stop loss @ 14.38 Details

The technical summary data is suggesting a short of VIXM as it gets near 14.34 with a downside target of 13.24. We should have a stop loss in place at 14.38though. 14.34 is the first level of resistance above 13.84, and by rule, any test of resistance is a short signal. In this case, if resistance 14.34 is being tested, so a short signal would exist.

Swing Trading Plans for VIXM

- Buy VIXM slightly over 14.34, target 15.82, Stop Loss @ 14.3 Details

If 14.34 begins to break higher, the technical summary data tells us to buy VIXM just slightly over 14.34, with an upside target of 15.82. The data also tells us to set a stop loss @ 14.3 in case the stock turns against the trade. 14.34 is the first level of resistance above 13.84, and by rule, any break above resistance is a buy signal. In this case, 14.34, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short VIXM slightly near 14.34, target 13.8, Stop Loss @ 14.38. Details

The technical summary data is suggesting a short of VIXM if it tests 14.34 with a downside target of 13.8. We should have a stop loss in place at 14.38 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 14.34, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

Day Trading Plans for VIXM

- Buy VIXM slightly over 14.34, target 15.82, Stop Loss @ 14.31 Details

If 14.34 begins to break higher, the technical summary data tells us to buy VIXM just slightly over 14.34, with an upside target of 15.82. The data also tells us to set a stop loss @ 14.31 in case the stock turns against the trade. 14.34 is the first level of resistance above 13.84, and by rule, any break above resistance is a buy signal. In this case, 14.34, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short VIXM slightly near 14.34, target 13.8, Stop Loss @ 14.37. Details

The technical summary data is suggesting a short of VIXM if it tests 14.34 with a downside target of 13.8. We should have a stop loss in place at 14.37 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 14.34, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

Check the time stamp on this data. Updated AI-Generated Signals for Proshares Vix Mid-term Futures Etf (VIXM) available here: VIXM.

VIXM Ratings for November 27:

| Term → | Near |

Mid |

Long |

|---|

| Rating |

Weak |

Weak |

Weak |

| P1 |

0 |

0 |

13.24 |

| P2 |

13.76 |

13.8 |

14.34 |

| P3 |

0 |

14.22 |

15.82 |

AI Generated Signals for VIXM

Blue = Current Price

Red = Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Instructions:

Click the Get Real Time Updates button below.

In the login prompt, select forgot username

Type the email you use for Factset

Use the user/pass you receive to login

You will have 24/7 access to real time updates.

From then on you can just click to get the real time update whenever you want.

GET REAL TIME UPDATES

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for VIXM: