Longer Term Trading Plans for PXQ

- Buy PXQ slightly over 90.48 target 96.23 stop loss @ 90.22 Details

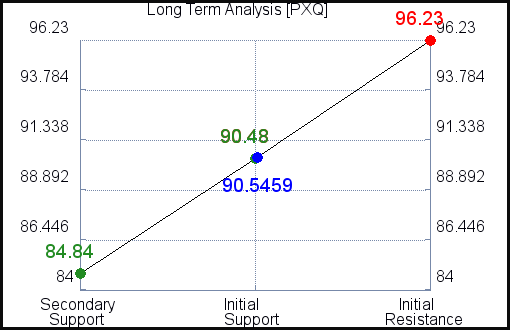

The technical summary data tells us to buy PXQ near 90.48 with an upside target of 96.23. This data also tells us to set a stop loss @ 90.22 to protect against excessive loss in case the stock begins to move against the trade. 90.48 is the first level of support below 90.5459 , and by rule, any test of support is a buy signal. In this case, support 90.48 is being tested, a buy signal would exist.

- Short PXQ under 96.23, target 90.48, stop loss @ 96.51 Details

The technical summary data is suggesting a short of PXQ as it gets near 96.23 with a downside target of 90.48. We should have a stop loss in place at 96.51though. 96.23 is the first level of resistance above 90.5459, and by rule, any test of resistance is a short signal. In this case, if resistance 96.23 is being tested, a short signal would exist.

Swing Trading Plans for PXQ

- Buy PXQ slightly over n/a, target n/a, Stop Loss @ 0 Details

If n/a begins to break higher, the technical summary data tells us to buy PXQ just slightly over n/a, with an upside target of n/a. The data also tells us to set a stop loss @ 0 in case the stock turns against the trade. n/a is the first level of resistance above 90.5459, and by rule, any break above resistance is a buy signal. In this case, n/a, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short PXQ near n/a, target 90.48, Stop Loss @ 0. Details

The technical summary data is suggesting a short of PXQ if it tests n/a with a downside target of 90.48. We should have a stop loss in place at 0 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, n/a, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

Day Trading Plans for PXQ

- Buy PXQ slightly over 96.23, target n/a, Stop Loss @ 96.01 Details

If 96.23 begins to break higher, the technical summary data tells us to buy PXQ just slightly over 96.23, with an upside target of n/a. The data also tells us to set a stop loss @ 96.01 in case the stock turns against the trade. 96.23 is the first level of resistance above 90.5459, and by rule, any break above resistance is a buy signal. In this case, 96.23, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short PXQ near 96.23, target 90.48, Stop Loss @ 96.45. Details

The technical summary data is suggesting a short of PXQ if it tests 96.23 with a downside target of 90.48. We should have a stop loss in place at 96.45 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 96.23, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

PXQ Ratings for June 25:

| Term → | Near |

Mid |

Long |

|---|

| Rating |

Strong |

Neutral |

Strong |

| P1 |

ERR |

ERR |

84.84 |

| P2 |

|

|

90.48 |

| P3 |

0 |

|

96.23 |

Support and Resistance Plot Chart for PXQ

Blue = Current Price

Red = Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.