Stimulus Matters to the Stock Market and to Acadia Realty Trust AKR

#Investors often shrug off the impact of #stimulus but when fabricated demand comes into the #stockmarket everything is affected, even Acadia Realty Trust (NYSE: AKR) and other stocks that might not be direct beneficiaries. They say, a rising tide lifts all boats, and multiple expansion is a natural byproduct, but it works in both ways. For AKR we can see the impact demand changes have on price by looking at the trading plans and pivot points below. This changes over time, so we suggest updating the data for the most actionable results, but this static example also demonstrates how this is done. For an update, please request Unlimited Real Time Reports.

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Neutral | Strong |

| P1 | 0 | 0 | 17.24 |

| P2 | 21.60 | 21.37 | 19.72 |

| P3 | 21.92 | 21.88 | 22.48 |

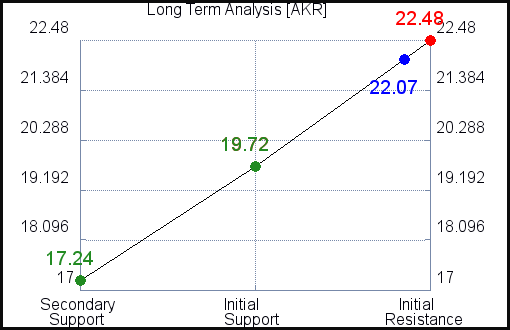

Support and Resistance Plot Chart for AKR

Longer Term Trading Plans for AKR

June 1, 2021, 10:15 am ET

AKR - (Long) Support Plan

Buy over 19.72 target 22.48 stop loss @ 19.66

AKR - (Short) Resistance Plan

Short under 22.48, target 19.72, stop loss @ 22.54

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial