Trading (COST) With Integrated Risk Controls

Price matters most to #makingmoney in the #stockmarket. Celebrating 20 years, Stock Traders Daily provides the tools that help you develop investment strategies, and this is a good example. When we couple this with our market based analysis, the probabilities of going with the flow increases, and that is material over time. The Costco Wholesale Corporation (NASDAQ: COST) report below can help you, but we have more details too. The trading plans for COST, and the other 1000+ stocks we follow, are updated in real time for subscribers, but this report is static. If you want an update, or a different report, please get one here Unlimited Real Time Reports.

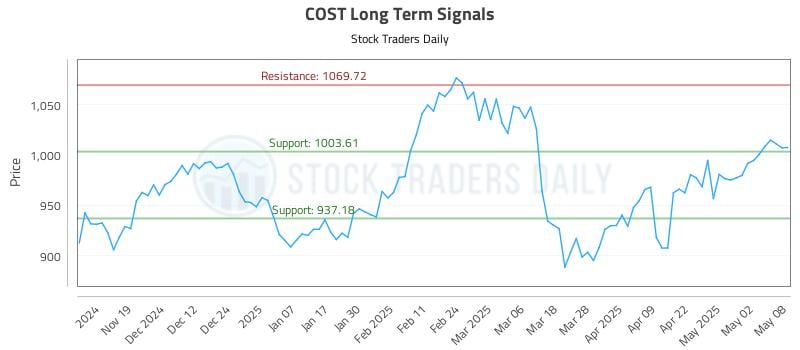

AI Generated Signals for COST

Blue = Current Price

Red = Resistance

Green = Support