Stock Analysis

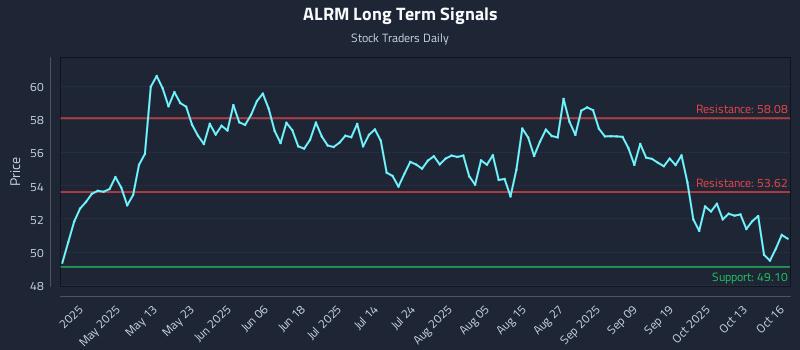

(ALRM) Volatility Zones as Tactical Triggers

Key findings for Alarm.com Holdings Inc. (NASDAQ: ALRM)

- Weak Sentiment Across All Horizons Supports Short Bias

- A mid-channel oscillation pattern is in play.

- Exceptional 32.3:1 risk-reward setup targets 9.2% gain vs 0.3% risk

- Signals: 49.10 · 50.81 · 53.62 · 58.08 (bold = current price)

- Weak Sentiment Across All Horizons Supports Short Bias — See current SIGNALS for positioning and risk parameters.

Institutional Trading Strategies

Our AI models have generated three distinct trading strategies tailored to different risk profiles and holding periods. Each strategy incorporates sophisticated risk management parameters designed to optimize position sizing and minimize drawdown risk.

Position Trading Strategy

LONG

Entry Zone

$49.10

Target

$53.62

Stop Loss

$48.96

Momentum Breakout Strategy

BREAKOUT

Trigger

$53.62

Target

$58.08

Stop Loss

$53.47

Risk Hedging Strategy

SHORT

Entry Zone

$53.62

Target

$50.94

Stop Loss

$53.78

Multi-Timeframe Signal Analysis

| Time Horizon | Signal Strength | Support Signal | Resistance Signal |

|---|---|---|---|

| Near-term (1-5 days) | Weak | $48.79 | $50.44 |

| Mid-term (5-20 days) | Weak | $49.26 | $50.75 |

| Long-term (20+ days) | Weak | $53.62 | $58.08 |

AI Generated Signals for ALRM

Blue = Current Price

Red = Resistance

Green = Support