Learn to Evaluate (VRTS) using the Charts

October 03, 2024, 21:50 pm ET, BY Allen K.- Contributor| Editor: Thomas H. Kee Jr. (Follow on LinkedIn)

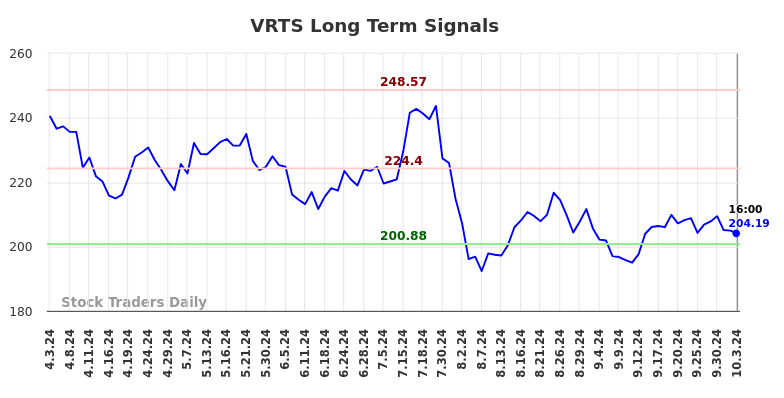

Longer Term Trading Plans for VRTS

- Buy VRTS near 200.88 target 224.4 stop loss @ 200.3 Details

The technical summary data tells us to buy VRTS near 200.88 with an upside target of 224.4. This data also tells us to set a stop loss @ 200.3 to protect against excessive loss in case the stock begins to move against the trade. 200.88 is the first level of support below 204.19 , and by rule, any test of support is a buy signal. In this case, support 200.88 would be being tested, so a buy signal would exist.

- Short VRTS slightly under 224.4, target 200.88, stop loss @ 225.05 Details

The technical summary data is suggesting a short of VRTS as it gets near 224.4 with a downside target of 200.88. We should have a stop loss in place at 225.05though. 224.4 is the first level of resistance above 204.19, and by rule, any test of resistance is a short signal. In this case, if resistance 224.4 is being tested, so a short signal would exist.

Swing Trading Plans for VRTS

- Buy VRTS slightly over 206.81, target 224.4, Stop Loss @ 206.21 Details

If 206.81 begins to break higher, the technical summary data tells us to buy VRTS just slightly over 206.81, with an upside target of 224.4. The data also tells us to set a stop loss @ 206.21 in case the stock turns against the trade. 206.81 is the first level of resistance above 204.19, and by rule, any break above resistance is a buy signal. In this case, 206.81, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short VRTS slightly near 206.81, target 203.3, Stop Loss @ 207.41. Details

The technical summary data is suggesting a short of VRTS if it tests 206.81 with a downside target of 203.3. We should have a stop loss in place at 207.41 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 206.81, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

Day Trading Plans for VRTS

- Buy VRTS slightly over 204.95, target 206.81, Stop Loss @ 204.47 Details

If 204.95 begins to break higher, the technical summary data tells us to buy VRTS just slightly over 204.95, with an upside target of 206.81. The data also tells us to set a stop loss @ 204.47 in case the stock turns against the trade. 204.95 is the first level of resistance above 204.19, and by rule, any break above resistance is a buy signal. In this case, 204.95, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short VRTS slightly near 204.95, target 203.3, Stop Loss @ 205.43. Details

The technical summary data is suggesting a short of VRTS if it tests 204.95 with a downside target of 203.3. We should have a stop loss in place at 205.43 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 204.95, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

Check the time stamp on this data. Updated AI-Generated Signals for Virtus Investment Partners Inc. (VRTS) available here: VRTS.

VRTS Ratings for October 03:

| Term → | Near |

Mid |

Long |

|---|

| Rating |

Weak |

Neutral |

Neutral |

| P1 |

0 |

0 |

200.88 |

| P2 |

202.82 |

203.3 |

224.4 |

| P3 |

204.95 |

206.81 |

248.57 |

AI Generated Signals for VRTS

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Instructions:Click the Get Real Time Updates button below.

In the login prompt, select forgot username

Type the email you use for Factset

Use the user/pass you receive to login

You will have 24/7 access to real time updates.

From then on you can just click to get the real time update whenever you want.

GET REAL TIME UPDATES

Our Market Crash Leading Indicator isEvitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change:Take a Trial

When #institutionalinvestors make decisions to buy and sell #stocks they normally want to keep it quiet. However, if we pay close attention we can see what is going on, and make good decisions.. The Virtus Investment Partners Inc. (NASDAQ: VRTS) report below can help you understand how to do this. The trading plans for VRTS, are updated in real time for subscribers, but this report is static. If you want an update, or a different report on a different stock, please get one here Unlimited Real Time Reports.

Fundamental Charts for VRTS:

pool ads

pool ads