QE2 and the future of the United States Economy

The debates over recent monetary policy are serious, and they cast shadows of doubt over not only the future health of the United States economy, but also the presence of the dollar as a stable world currency. As a direct result, the value of US debt has come under serious question. This analysis suggests that the Federal Reserve may be seeing more selling pressure than it expected.

The US government is dependent on demand for treasury bonds to revolve the debt burden of the country. Without institutional and foreign demand for US treasuries the government of the United States would need to print money endlessly. Although recent action might encourage some to argue otherwise, no one expects the US government to stop issuing treasury bonds and start printing money. Instead, more probably, the world expects the government to issue more treasury bonds, more supply, and try to fabricate demand as it does so.

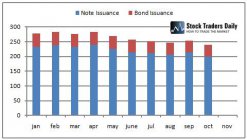

This table shows the issuance of both treasury bonds and notes in calendar 2010. The figures are in billions of dollars, and the chart suggests that every month since January the treasury has issued approximately $225 Billion worth of bonds and notes every month. This table does not include treasury bills or inflation protected securities. Until recently, the demand for these bonds has steadily increased. Perceived value in the safe haven called the dollar attracted investors from all parts of the globe.

One of the objectives of the Federal Reserve must be to sustain a demand for treasury bonds. This is not only the responsibility of one facet of our government, but a responsibility of our entire government. If we are not able to offer perceived value for our debt than the demand that we have been dependant on to revolve and increase the deficit will in turn decline. That is what has been happening recently.

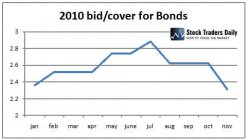

In the chart below, I illustrate the bid to cover ratio for U.S. Treasury bonds in calendar 2010. Until July, the bid to cover ratio was increasing steadily. Then, suddenly, the bid to cover ratio of U.S. Treasury bonds began to decline aggressively. After the most recent issuance, the bid to cover ratio for U.S. Treasury bonds had dropped to the lowest level of the year.

Historically, this is not only a measure of demand, but it also a predeterinate of cost. The lower the demand for U.S. Treasury bonds, the higher the interest payments will be, and the more expensive the debt burden as a result. With the Target Rate at zero, the recent environment has been a sweet spot for deficit spending and revolving debt facilities. With focus on the short side of the curve, the U.S. Treasury could issue debt for virtually nothing, and keep its burden quite low.

Unfortunately, the declining bid to cover ratio suggests those days may be numbered.

Coincidentally, or maybe not, the decline in the bid to cover ratio began almost at the same time as the first indication of the second round of quantitive easing was made public. The government has already been in the market, but not as aggressively as it plans to be in the future. Since August, the Federal Reserve has been buying bonds. In doing so, the Federal Reserve takes offers from willing sellers. From a list of willing sellers, using criteria not available to the general public, but criteria that can be surmised nonetheless, the government selects from that list the willing sellers it will accept bonds from. As the chart below suggests, most of those willing sellers are not accommodated. My assessment is that the criteria set forth include a focus on US institutions, specifically investors who are in need of liquid assets and willing to use it to reinvest.

Most people have surmised that the money being infused into the system would roll directly into the stock market. That is the reason, at least one of them, for the recent surge. My summation suggests that the selective acceptance by the Federal Reserve is targeted more to financial institutions who might lend the money rather than to investors who might invest it into the stock market. That includes US banks specifically. The objective is reasonable, with the understanding that if they had more money to land they would probably lend more. This is intended as a stimulative effort, something that Ben Bernanke believes is necessary, but something that the government itself is unable to provide. Congress and the White House are not expected to agree on any new stimulus program, so Ben has to do it.

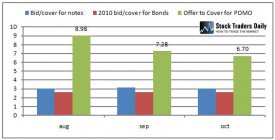

Unfortunately, given the table below, the Federal Reserve may have been surprised. Since August, when they first began to buy in the open market, the offers to sell U.S. Treasury bonds back to the government have been much higher than the willingness of the Federal Reserve to buy those same bonds.

With further illustration, the table below compares the bid to cover for treasury notes and treasury bonds to the offer to cover for POMO. Conservatively, be offer to cover has been more than double the bid to cover every month since the Fed chairman announced his intention.

This begs the question, did the Federal Reserve expect there to be so many sellers willing to take part in this program, or was the government's surprised and taken off guard instead?

Like any businessman would do, when demand is higher, we increase supply. This situation is a little different, but the concept is the same. Because the offer to sell U.S. Treasury bonds in this program was so much higher than what the government was prepared for, it was forced to aggressively increase the monthly purchase amounts. There are more willing sellers than willing buyers. Demand for U.S. Treasury bonds as defined in the bid to cover ratio has started to decline aggressively already, and the US government will probably be required to pay more to fund its revolving debt as a result.

If the intention of QE2 was to keep rates low, the US government would need to buy more U.S. Treasury bonds in the open market than being offered by willing sellers. Given the data from the past few months, since QE2 was announced, the projected POMO activity already outlined by the government does not match the selling pressure thus far. POMO will either need to increase considerably, almost double, or the willing sellers will need to be dissuaded from making offers. We will need to monitor this to see if the offer to sell ratio comes down to parity, and if it dies maybe the federal reserve will be able to lower interest rates, but unless it dies interest rates are much more likely to increase.

Furthermore, the effect of QE2 as a stimulative measure comes into serious question. If there are more sellers in the market than the government expected, and rates trickle higher, one of the objectives of QE2 will have been wiped out. The second objective, an infusion of capital into the system, would then be the sole survivor of this policy measure. Most likely, financial institutions who are making offers to sell are the ones being accepted by the Federal Reserve.

Unfortunately, US financial institutions are faced with additional burdens. The most obvious burden is demand. Financial institutions have already eased lending standards, but the demand for new loans simply is not there. Much of this is defined by The Investment Rate. Secondly, large US financial institutions are also faced with additional reserve requirements. The most recent earnings releases suggested that those companies were releasing reserves, and in doing so those companies were able to beat earnings estimates without growing revenue. Given the potential put backs that the big companies face, an increase in reserves should be expected across the board.

Although the infusion of capital into the financial system sounds good on paper, without demand and in the face of added reserves, that money is unlikely to find its way into the system. That offsets the second part of the two-part objective of QE2. Now, not only will interest rates probably trickle higher, but the intended infusion of this money will not reach its target. If that is true, then the recent increases in the market are indeed based on a purposeful manipulation that may be doomed to fail.

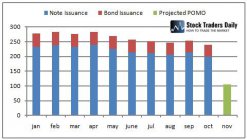

Even if the second part of the objective is satisfied, assuming that the US treasury continues to issue bonds and notes at the same rate as it has all year, the government is still siphoning money from the system, just less than it otherwise would. The table below compares what has been issued to what is projected to be purchased. How can the government increase the velocity of money and real inflation if they continue to siphon money out of the system?

Therein lays the concern. If the government continues to siphon money it will reduce the velocity of money, and prevent real inflation. Instead, the inflationary pressures will be solely commodity-based. That is detrimental to margins. Corporate America and recent earnings rely on those margins. Therefore, not only is this program potentially detrimental to the health of our economy by increasing the real deficit and lowering the value of our currency, but it also takes aim at the only positive fundamental driver that exists today.

Our companies are lean, slight increases in revenue result in large earnings increases, but the opposite can also be true in this environment. Slight increases in costs can reduce margins, lower earnings results, and cause multiple contractions instead.

Unless the money finds its way into the hands of consumers, real inflation will not exist. If the above is true, the investors expecting higher market levels, those investors who are multiplying the QE2 stimulus dollars by institutional margin availability and expecting that to be infused into the system, may be sorely mistaken. Soon, I expect the perception of QE2 to change dramatically. It has opened a can of worms. There are many more sellers of US debt than anyone expected, margin pressures exist across the board, and because consumers are not able to pay much more, corporations will find it very difficult to pass along added costs.

Support and Resistance Plot Chart for

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial

Fundamental Charts for :